State Farm Knob and Tube Wiring: Will They Insure Your Home?

You’ve found the perfect older home, full of character and charm. But during the inspection, a term you’ve never heard before comes up: knob and tube wiring. Suddenly, your dream home feels like a potential nightmare, especially when it comes to getting homeowners insurance. The big question for many is, will a major insurer like State Farm cover a house with knob and tube wiring?

This is a critical hurdle for countless homebuyers and owners of historic properties. The fear of being denied coverage, facing sky-high premiums, or being forced into a costly rewire can be overwhelming. Understanding the landscape of insurance for homes with this vintage electrical system is the first step toward a solution.

You'll Learn About

Why Insurance Companies Are Wary of Knob and Tube Wiring

To understand State Farm’s position, it’s essential to know why knob and tube (K&T) wiring is a red flag for most insurance carriers. Installed in homes from the 1880s to the 1940s, K&T was a standard and effective wiring method for its time. However, it lacks several key safety features found in modern electrical systems, creating a higher risk profile from an insurer’s perspective.

The primary concerns revolve around safety and the system’s inability to meet the demands of modern electrical loads. These issues form the basis of most insurance underwriting guidelines and are the reason you might face challenges securing a policy.

The Inherent Risks of Knob and Tube Systems

Insurance companies are in the business of risk assessment. With K&T wiring, they see several potential hazards that increase the likelihood of a claim, particularly from fire. This is not just theoretical; the design and age of K&T wiring present tangible dangers in a modern home.

One of the most significant issues is the lack of a ground wire. Modern electrical systems use a ground wire as a crucial safety feature to protect against electrical shock and fire. K&T systems only have a hot and a neutral wire, meaning they cannot accommodate three-prong outlets without creating a false sense of security, and they offer less protection if a fault occurs.

Another major problem is the insulation. The original rubberized cloth insulation on K&T wires becomes brittle and deteriorates over time. This degradation can expose live wires, creating a severe fire hazard, especially if they are disturbed or come into contact with flammable materials. Decades of unmonitored existence within walls can hide this decay.

Furthermore, K&T wiring was designed to be suspended in open air to dissipate heat. When modern insulation, such as blown-in cellulose or fiberglass, is installed in walls and attics, it can smother the wires. This prevents proper heat dissipation, causing the wires to overheat and potentially ignite the surrounding insulation or wooden framing.

Improper Modifications and Overloading

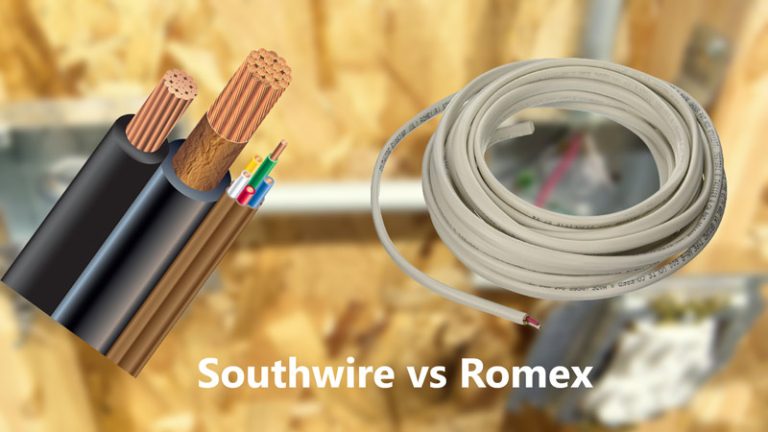

Over the decades, many K&T systems have been improperly modified by homeowners or unqualified electricians. It’s common to find modern Romex wiring dangerously spliced into the old K&T system, often without proper junction boxes and using only electrical tape. These amateur connections are notorious failure points that can lead to sparks and fires.

The electrical demands of the early 20th century were minimal—perhaps a few lights and a radio. Today’s homes are packed with high-draw appliances like microwaves, computers, and HVAC systems. K&T systems were not designed to handle these heavy electrical loads, and overloading the circuits is a common cause of overheating and fires.

It’s this combination of age, outdated design, and the high potential for unsafe modifications that makes insurers nervous. For a company like State Farm, which has to balance risk across millions of policies, insuring a home with active K&T wiring is a significant gamble.

Navigating State Farm’s Knob and Tube Wiring Policy

So, what is State Farm’s official stance? It’s not always a simple yes or no. While some internal underwriting documents have listed knob and tube wiring as “unacceptable,” the company often assesses properties on a case-by-case basis. Several factors can influence their decision to offer or deny coverage.

Reports and homeowner experiences vary by state and even by the individual agent and underwriter. Some homeowners have been insured without issue, while others have been denied outright or given a short window to replace the wiring after closing. The key is understanding what factors they evaluate and how you can present your home in the best possible light.

The Deciding Factors for Underwriters

When a State Farm underwriter reviews an application for a home with K&T, they are primarily concerned with the level of active risk. They want to know the extent and condition of the wiring. A home where K&T is only present in a few lighting circuits and is in pristine, unmodified condition is a much lower risk than a home where it services kitchens and bathrooms and has been dangerously altered.

A certified electrical inspection is often the most critical piece of evidence. If you can provide a report from a licensed electrician stating that the K&T system is in good condition, has not been improperly modified, and is not overloaded or surrounded by insulation, your chances of getting coverage improve dramatically. The insurer needs assurance that the system is safe as it currently exists.

The percentage of K&T wiring in the home is another crucial factor. If the majority of the home has been updated to modern wiring, and only a small, easily accessible portion remains K&T, the risk is considered much lower. Documenting these upgrades is vital.

Actionable Steps to Secure Insurance Coverage

If you own or are looking to buy a home with knob and tube wiring, don’t despair. There are proactive steps you can take to mitigate the risks and successfully secure a homeowners policy from a carrier like State Farm. The solution involves demonstrating safety and, in many cases, planning for an eventual upgrade.

Your goal is to shift the underwriter’s perception from “high-risk antique” to “well-maintained historic system.” This requires professional assessment, careful documentation, and a clear plan of action.

Step 1: Get a Professional Electrical Evaluation

Before you even approach an insurance agent, hire a licensed electrician with specific experience in older homes and K&T wiring. They can provide a detailed assessment of your system’s condition. This inspection should verify that the wire insulation is intact, there are no dangerous modifications, and the wiring is not in contact with insulation.

Ask the electrician for a formal letter or report detailing their findings. This document is your most powerful tool when speaking with an insurer. If the electrician identifies minor issues, have them repaired immediately to show you are proactive about safety.

Step 2: Deactivate and Replace Critical Circuits

Even if a full rewire isn’t immediately feasible, you can significantly reduce the risk profile by strategically replacing the most hazardous portions of the K&T system. Focus on high-load areas first. Circuits serving kitchens, bathrooms, laundry rooms, and outdoor areas should be prioritized for replacement.

These areas not only draw the most power but also have a higher risk of moisture, which is especially dangerous with ungrounded wiring. Replacing these circuits and leaving the K&T system to power only low-demand lighting circuits can often satisfy insurance requirements. This approach shows a commitment to safety and phased modernization. For those facing this task, understanding the process of a rewire in a house with plaster walls can be incredibly beneficial.

Step 3: Document Everything and Communicate Clearly

When you apply for insurance, present all your documentation upfront. Provide the electrician’s report, receipts for any repairs or partial upgrades, and photos if they help illustrate the wiring’s good condition. A clear, organized presentation demonstrates that you are a responsible homeowner who has taken the issue seriously.

If you have a plan to replace the remaining K&T wiring over a specific timeframe, share that as well. Some insurers may be willing to write a policy on the condition that the remaining wiring is replaced within a certain period, such as one to two years. It’s also helpful to compare the dangers of older systems; for instance, understanding the differences in a cloth wiring vs knob and tube comparison can highlight why proactive replacement is a smart long-term investment.

Finally, remember that older homes have other unique risks. Be aware of other potential issues, like the state of your plumbing and major appliances. After all, hidden dangers are not limited to wiring; knowing how fragile water heaters are can also prevent a different kind of household disaster.

| Action Item | Primary Goal | Impact on Insurance Application |

|---|---|---|

| Full Electrical Inspection | Assess and document the current state and safety of the K&T wiring. | Provides a professional, third-party validation of the system’s condition, which is crucial for underwriters. |

| Prioritized Replacement | Remove K&T from high-risk, high-load areas (kitchen, bath, laundry). | Significantly reduces the perceived fire risk, making the property much more attractive to insure. |

| Remove Insulation Contact | Ensure no insulation is surrounding or covering the K&T wires. | Eliminates the risk of overheating, a primary concern for insurers. |

| Correct Unsafe Modifications | Remove any improper splices and install proper junction boxes. | Demonstrates a commitment to electrical safety and code compliance. |

| Develop a Full Rewire Plan | Create a timeline and budget for replacing all remaining K&T wiring. | Shows underwriters a long-term commitment to risk mitigation, potentially securing a policy with a replacement clause. |

The Long-Term Solution: Planning for a Full Rewire

While you may be able to secure insurance with active K&T wiring in the short term, the ultimate solution is a full replacement. No matter how well-maintained, K&T wiring is an obsolete technology that will continue to pose challenges for homeowners. Planning for a full rewire is not just about insurability; it’s about the long-term safety and functionality of your home.

The cost to replace knob and tube wiring can range from $8,000 to $20,000 or more, depending on the size of your home and the accessibility of the walls. While this is a significant investment, it increases your home’s safety, value, and appeal to future buyers. It also gives you peace of mind and eliminates the insurance headache for good.

Start by getting multiple quotes from qualified electricians. They can help you develop a phased approach to spread the cost over time if necessary. By proactively addressing your home’s knob and tube wiring, you can protect your investment and ensure you have the reliable, comprehensive insurance coverage you need from a carrier like State Farm.